The intricate dance between the Depth of Market (DOM) and market volatility is a captivating subject that warrants closer examination. As financial markets oscillate in response to news, investor sentiment, and macroeconomic indicators, the DOM—an essential tool that provides a snapshot of order flow—offers a unique lens through which to interpret these fluctuations.

Picture a bustling marketplace, where every bid and ask reflects the very heartbeat of trading activity. In this vibrant ecosystem, how do the nuances of DOM interact with sudden spikes in volatility? Can the layers of buy and sell orders predict impending turbulence, or are they merely a silent witness to the chaos unfolding? In this exploration, we will unravel the complex interplay between DOM metrics and market volatility, shedding light on how traders can harness this knowledge to navigate the tempestuous seas of the financial world.

Prepare for a journey through dynamic data, analytical insights, and a deeper understanding of what drives the unpredictable nature of markets.

Understanding Depth of Market (DOM)

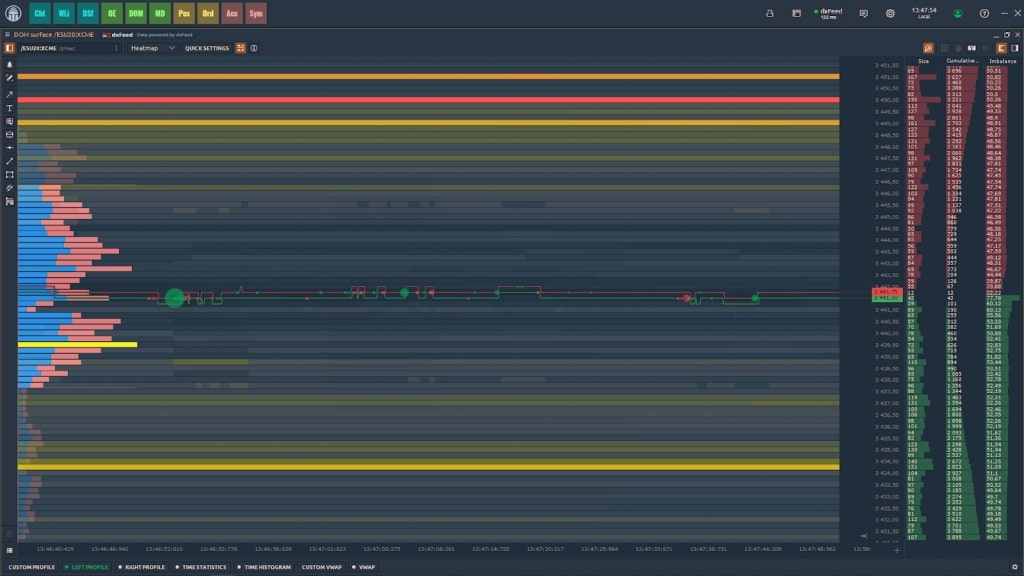

Understanding Depth of Market (DOM) is essential for grasping the nuances of market dynamics and the movements that influence volatility. At its core, DOM provides a snapshot of the buying and selling interest at various price levels, unveiling the intricate layers of supply and demand.

It reflects the number of shares or contracts available at certain prices, offering traders insight into potential price movements. As market conditions fluctuate, DOM reveals how quickly orders can be executed and where significant support or resistance lies.

Moreover, by analyzing the flow of buy and sell orders, traders can glean valuable information about market sentiment—are participants eager to buy, or is fear of selling looming large? Such insights not only inform trading strategies but also highlight the potential for sharp price swings, making DOM an indispensable tool in understanding and navigating the unpredictable waters of market volatility.

Defining Market Volatility

Market volatility refers to the degree of variation in trading prices over time within a financial market. It serves as a critical indicator of market stability, encompassing the fluctuations in asset prices that can arise from numerous factors, including economic data releases, geopolitical events, and shifts in investor sentiment.

When volatility spikes, it often signifies increased uncertainty among traders, leading to rapid price movements and, at times, panic selling or frenetic buying spirals. This erratic behavior can create opportunities, but it can also amplify risks, requiring investors to navigate a landscape where the only constant is change.

Understanding the nuances of market volatility is essential for comprehending how different market dynamics, such as depth of market (DOM), interact and influence investment strategies.

Volatility Triggers: A Closer Look at DOM Indicators

In the intricate tapestry of market dynamics, the Depth of Market (DOM) indicators serve as vital signals that illuminate the prevailing volatility landscape. When large buy or sell orders suddenly appear—or vanish—they can act like a lightning bolt, sending shockwaves through trading floors.

For instance, an unexpected accumulation of sell orders can foreshadow a downward spiral, while a surge in buy orders might ignite bullish momentum, creating a rapid shift in market sentiment. Traders attuned to these fluctuations often interpret them as precursors to larger market movements, turning their strategies on a dime.

The interplay between DOM fluctuations and volatility is not merely a statistical correlation; its a living phenomenon, driven by the collective psychology of market participants, making it essential for investors to keep a keen eye on these indicators as they navigate the chaotic currents of trading.

Conclusion

In conclusion, the relationship between Depth of Market (DOM) and market volatility is a critical area of study for traders and investors alike. Understanding how DOM impacts price fluctuations can provide valuable insights into market dynamics and inform trading strategies.

As volatility increases, the depth of market can serve as a vital indicator of potential price movements, revealing the underlying supply and demand pressures within the market. By closely monitoring DOM along with other market indicators, participants can better navigate the complexities of volatility, ultimately leading to more informed decision-making and improved trading outcomes.

As the financial landscape continues to evolve, ongoing research and analysis into these relationships will be essential for adapting to changing market conditions.